Deep report on nickel metal industry: meeting the high light age of nickel sulfate

2021-07-22

Summary of the report:

Meet the bright era of nickel sulfate

The dual supply and demand matching of nickel is the core to understand the change of nickel industry. The supply and demand matching of "laterite nickel mine high nickel power battery" will open the bright era of nickel sulfate. In terms of dual supply, the supply of nickel sulphide ore decreased, while laterite nickel ore needed to be expanded; In terms of dual demand, the steady growth of stainless steel and the global trend of new energy vehicles with high nickel content will drive the accelerated growth of nickel sulfate demand; The traditional dual supply-demand matching of nickel can be divided into two paths, one is nickel sulfide electrolytic nickel stainless steel + battery, the other is nickel laterite stainless steel. We believe that the main contradiction of nickel industry in the long term in the future will focus on how to match the supply of laterite nickel ore with great resource potential with the increasing demand for nickel sulfate under the background of insufficient nickel sulfide ore resources. We expect that the supply and demand of nickel sulfate will continue to tighten from 2021 to 2025, and the gap may reach 65000 metal tons in 2025. The companies that can solve the above main contradictions and realize the supply and demand matching of "laterite nickel mine high nickel power battery" will get rich returns.

In the next five years, the CAGR growth rate of power lithium battery's demand for nickel sulfate will be as high as 40%. The demand for nickel in power lithium batteries is expected to be systematically higher than the growth rate of new energy vehicles. Firstly, the charged capacity of single vehicle will be increased, and secondly, the power batteries will be highly nickel. Our calculation shows that the CAGR growth rate of nickel sulfate demand in power battery field in the next five years will be as high as 40%. Although stainless steel is still the largest consumer of nickel, the power battery industry will have the largest growth rate of nickel demand in the future, and the proportion of battery demand is expected to increase from about 5% in 2019 to 17% in 2025.

Indonesia has become the main growth pole of nickel sulfate supply, and the barriers are gradually rising. Indonesia will be the main battlefield of nickel sulfate industry in the future. First, Indonesia is the largest nickel reserve and output in the world, and also the region with the largest new nickel supply capacity; Second, Indonesia has gradually improved its supporting infrastructure by banning mining twice; Third, it is close to China, the global lithium demand center; Fourthly, Indonesia's nickel market is still less monopolistic than that of the Philippines and sinca, so it has a good opportunity to intervene. There are three barriers in the layout of preparing nickel sulfate from laterite nickel ore in Indonesia, and the advanced entrants have the advantage. First, capital expenditure barriers. Indonesia's ban on raw ore export forces industrial capital to invest and set up factories locally, which will lengthen the capital expenditure cycle. The second is the barrier of mining right examination and approval. Due to the strong control of mineral resources by the Indonesian government, the barrier of latecomers is gradually raised. The third is technical barriers. Nickel project has huge investment and complex technology, which needs strong financial and technical support. By the end of 2020, there are 7 laterite nickel projects under construction or planned to be constructed in Indonesia for the demand of new energy vehicle industry, with a production capacity of 279000 tons. The planned production time is mainly concentrated in 2022-2023.

CO + Ni + cathode precursor (cathode) integration has a strong core competitiveness. Firstly, the high concentration of global cobalt and nickel resources determines that the resource availability itself is a barrier. Secondly, the capital and technical barriers of copper cobalt and nickel cobalt mines and smelting are high; Third, new energy vehicle manufacturers and battery manufacturers have high requirements for the stability, safety and consistency of battery material supply, which makes the upstream suppliers with high integration have strong bargaining power and customer stickiness. The upstream companies of cathode materials take the road of vertical integration. In essence, they integrate the middle and lower reaches with the monopoly power of resources, so as to reduce the cost, expand the scale, increase the market share and enhance the bargaining power after integration, and expand the monopoly power of resources to the monopoly power of cathode materials.

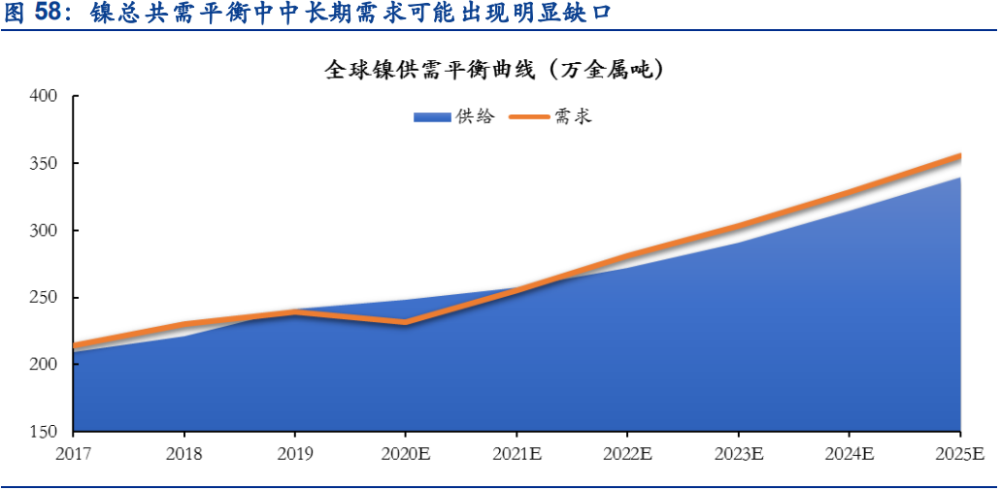

The global supply and demand of nickel sulfate and nickel is expected to be in shortage in 2021, and the gap will gradually expand in the next five years. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity are expected to usher in a major opportunity of revaluation. It is estimated that the global demand for nickel sulfate (physical quantity) will increase from 690000 tons to 2.84 million tons in 2020-2025, and the gap will gradually appear from 2021, with the gap of - 0.66, - 3.42, - 2.56, - 2.79, - 6.53 million tons respectively in 2021-2025; The global nickel supply and demand balance will be 176, - 9.10, - 12.15, - 14.55, - 16.12 million tons respectively from 2021 to 2025. The tightening of supply and demand will drive up the price of nickel sulfate, and then drive up the central system of nickel price. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity will usher in a major revaluation opportunity.

1. The dual supply and demand matching of nickel is the core to understand the change of nickel industry

1.1. Dual supply: the supply of nickel sulfide ore decreased, while laterite nickel ore continued to expand

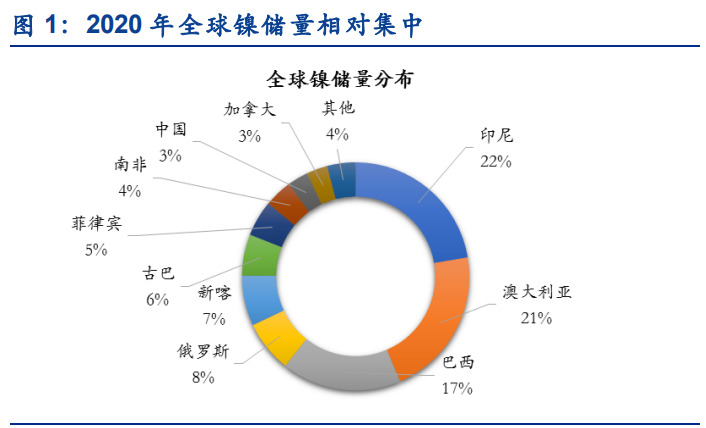

The global nickel reserves are relatively concentrated. In recent years, the growth of global nickel reserves mainly comes from laterite nickel. According to the US Geological Survey (USGS), the global nickel reserves in 2020 will be 94 million tons, unchanged year on year, with laterite nickel ore accounting for 60% and sulfide nickel ore accounting for 40%. Among them, Indonesia's nickel reserves remain unchanged at 21 million tons, which is still the country with the most abundant nickel resources, followed by Australia, Brazil, Russia, Singapore, Cuba, the Philippines and other countries. China is a nickel poor country with reserves of about 2.8 million tons, mainly concentrated in Jinchuan nickel mine, accounting for about 3% of the world.

Summary of the report:

Meet the bright era of nickel sulfate

The dual supply and demand matching of nickel is the core to understand the change of nickel industry. The supply and demand matching of "laterite nickel mine high nickel power battery" will open the bright era of nickel sulfate. In terms of dual supply, the supply of nickel sulphide ore decreased, while laterite nickel ore needed to be expanded; In terms of dual demand, the steady growth of stainless steel and the global trend of new energy vehicles with high nickel content will drive the accelerated growth of nickel sulfate demand; The traditional dual supply-demand matching of nickel can be divided into two paths, one is nickel sulfide electrolytic nickel stainless steel + battery, the other is nickel laterite stainless steel. We believe that the main contradiction of nickel industry in the long term in the future will focus on how to match the supply of laterite nickel ore with great resource potential with the increasing demand for nickel sulfate under the background of insufficient nickel sulfide ore resources. We expect that the supply and demand of nickel sulfate will continue to tighten from 2021 to 2025, and the gap may reach 65000 metal tons in 2025. The companies that can solve the above main contradictions and realize the supply and demand matching of "laterite nickel mine high nickel power battery" will get rich returns.

In the next five years, the CAGR growth rate of power lithium battery's demand for nickel sulfate will be as high as 40%. The demand for nickel in power lithium batteries is expected to be systematically higher than the growth rate of new energy vehicles. Firstly, the charged capacity of single vehicle will be increased, and secondly, the power batteries will be highly nickel. Our calculation shows that the CAGR growth rate of nickel sulfate demand in power battery field in the next five years will be as high as 40%. Although stainless steel is still the largest consumer of nickel, the power battery industry will have the largest growth rate of nickel demand in the future, and the proportion of battery demand is expected to increase from about 5% in 2019 to 17% in 2025.

Indonesia has become the main growth pole of nickel sulfate supply, and the barriers are gradually rising. Indonesia will be the main battlefield of nickel sulfate industry in the future. First, Indonesia is the largest nickel reserve and output in the world, and also the region with the largest new nickel supply capacity; Second, Indonesia has gradually improved its supporting infrastructure by banning mining twice; Third, it is close to China, the global lithium demand center; Fourthly, Indonesia's nickel market is still less monopolistic than that of the Philippines and sinca, so it has a good opportunity to intervene. There are three barriers in the layout of preparing nickel sulfate from laterite nickel ore in Indonesia, and the advanced entrants have the advantage. First, capital expenditure barriers. Indonesia's ban on raw ore export forces industrial capital to invest and set up factories locally, which will lengthen the capital expenditure cycle. The second is the barrier of mining right examination and approval. Due to the strong control of mineral resources by the Indonesian government, the barrier of latecomers is gradually raised. The third is technical barriers. Nickel project has huge investment and complex technology, which needs strong financial and technical support. By the end of 2020, there are 7 laterite nickel projects under construction or planned to be constructed in Indonesia for the demand of new energy vehicle industry, with a production capacity of 279000 tons. The planned production time is mainly concentrated in 2022-2023.

CO + Ni + cathode precursor (cathode) integration has a strong core competitiveness. Firstly, the high concentration of global cobalt and nickel resources determines that the resource availability itself is a barrier. Secondly, the capital and technical barriers of copper cobalt and nickel cobalt mines and smelting are high; Third, new energy vehicle manufacturers and battery manufacturers have high requirements for the stability, safety and consistency of battery material supply, which makes the upstream suppliers with high integration have strong bargaining power and customer stickiness. The upstream companies of cathode materials take the road of vertical integration. In essence, they integrate the middle and lower reaches with the monopoly power of resources, so as to reduce the cost, expand the scale, increase the market share and enhance the bargaining power after integration, and expand the monopoly power of resources to the monopoly power of cathode materials.

The global supply and demand of nickel sulfate and nickel is expected to be in shortage in 2021, and the gap will gradually expand in the next five years. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity are expected to usher in a major opportunity of revaluation. It is estimated that the global demand for nickel sulfate (physical quantity) will increase from 690000 tons to 2.84 million tons in 2020-2025, and the gap will gradually appear from 2021, with the gap of - 0.66, - 3.42, - 2.56, - 2.79, - 6.53 million tons respectively in 2021-2025; The global nickel supply and demand balance will be 176, - 9.10, - 12.15, - 14.55, - 16.12 million tons respectively from 2021 to 2025. The tightening of supply and demand will drive up the price of nickel sulfate, and then drive up the central system of nickel price. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity will usher in a major revaluation opportunity.

1. The dual supply and demand matching of nickel is the core to understand the change of nickel industry

1.1. Dual supply: the supply of nickel sulfide ore decreased, while laterite nickel ore continued to expand

The global nickel reserves are relatively concentrated. In recent years, the growth of global nickel reserves mainly comes from laterite nickel. According to the US Geological Survey (USGS), the global nickel reserves in 2020 will be 94 million tons, unchanged year on year, with laterite nickel ore accounting for 60% and sulfide nickel ore accounting for 40%. Among them, Indonesia's nickel reserves remain unchanged at 21 million tons, which is still the country with the most abundant nickel resources, followed by Australia, Brazil, Russia, Singapore, Cuba, the Philippines and other countries. China is a nickel poor country with reserves of about 2.8 million tons, mainly concentrated in Jinchuan nickel mine, accounting for about 3% of the world.

Summary of the report:

Meet the bright era of nickel sulfate

The dual supply and demand matching of nickel is the core to understand the change of nickel industry. The supply and demand matching of "laterite nickel mine high nickel power battery" will open the bright era of nickel sulfate. In terms of dual supply, the supply of nickel sulphide ore decreased, while laterite nickel ore needed to be expanded; In terms of dual demand, the steady growth of stainless steel and the global trend of new energy vehicles with high nickel content will drive the accelerated growth of nickel sulfate demand; The traditional dual supply-demand matching of nickel can be divided into two paths, one is nickel sulfide electrolytic nickel stainless steel + battery, the other is nickel laterite stainless steel. We believe that the main contradiction of nickel industry in the long term in the future will focus on how to match the supply of laterite nickel ore with great resource potential with the increasing demand for nickel sulfate under the background of insufficient nickel sulfide ore resources. We expect that the supply and demand of nickel sulfate will continue to tighten from 2021 to 2025, and the gap may reach 65000 metal tons in 2025. The companies that can solve the above main contradictions and realize the supply and demand matching of "laterite nickel mine high nickel power battery" will get rich returns.

In the next five years, the CAGR growth rate of power lithium battery's demand for nickel sulfate will be as high as 40%. The demand for nickel in power lithium batteries is expected to be systematically higher than the growth rate of new energy vehicles. Firstly, the charged capacity of single vehicle will be increased, and secondly, the power batteries will be highly nickel. Our calculation shows that the CAGR growth rate of nickel sulfate demand in power battery field in the next five years will be as high as 40%. Although stainless steel is still the largest consumer of nickel, the power battery industry will have the largest growth rate of nickel demand in the future, and the proportion of battery demand is expected to increase from about 5% in 2019 to 17% in 2025.

Indonesia has become the main growth pole of nickel sulfate supply, and the barriers are gradually rising. Indonesia will be the main battlefield of nickel sulfate industry in the future. First, Indonesia is the largest nickel reserve and output in the world, and also the region with the largest new nickel supply capacity; Second, Indonesia has gradually improved its supporting infrastructure by banning mining twice; Third, it is close to China, the global lithium demand center; Fourthly, Indonesia's nickel market is still less monopolistic than that of the Philippines and sinca, so it has a good opportunity to intervene. There are three barriers in the layout of preparing nickel sulfate from laterite nickel ore in Indonesia, and the advanced entrants have the advantage. First, capital expenditure barriers. Indonesia's ban on raw ore export forces industrial capital to invest and set up factories locally, which will lengthen the capital expenditure cycle. The second is the barrier of mining right examination and approval. Due to the strong control of mineral resources by the Indonesian government, the barrier of latecomers is gradually raised. The third is technical barriers. Nickel project has huge investment and complex technology, which needs strong financial and technical support. By the end of 2020, there are 7 laterite nickel projects under construction or planned to be constructed in Indonesia for the demand of new energy vehicle industry, with a production capacity of 279000 tons. The planned production time is mainly concentrated in 2022-2023.

CO + Ni + cathode precursor (cathode) integration has a strong core competitiveness. Firstly, the high concentration of global cobalt and nickel resources determines that the resource availability itself is a barrier. Secondly, the capital and technical barriers of copper cobalt and nickel cobalt mines and smelting are high; Third, new energy vehicle manufacturers and battery manufacturers have high requirements for the stability, safety and consistency of battery material supply, which makes the upstream suppliers with high integration have strong bargaining power and customer stickiness. The upstream companies of cathode materials take the road of vertical integration. In essence, they integrate the middle and lower reaches with the monopoly power of resources, so as to reduce the cost, expand the scale, increase the market share and enhance the bargaining power after integration, and expand the monopoly power of resources to the monopoly power of cathode materials.

The global supply and demand of nickel sulfate and nickel is expected to be in shortage in 2021, and the gap will gradually expand in the next five years. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity are expected to usher in a major opportunity of revaluation. It is estimated that the global demand for nickel sulfate (physical quantity) will increase from 690000 tons to 2.84 million tons in 2020-2025, and the gap will gradually appear from 2021, with the gap of - 0.66, - 3.42, - 2.56, - 2.79, - 6.53 million tons respectively in 2021-2025; The global nickel supply and demand balance will be 176, - 9.10, - 12.15, - 14.55, - 16.12 million tons respectively from 2021 to 2025. The tightening of supply and demand will drive up the price of nickel sulfate, and then drive up the central system of nickel price. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity will usher in a major revaluation opportunity.

1. The dual supply and demand matching of nickel is the core to understand the change of nickel industry

1.1. Dual supply: the supply of nickel sulfide ore decreased, while laterite nickel ore continued to expand

The global nickel reserves are relatively concentrated. In recent years, the growth of global nickel reserves mainly comes from laterite nickel. According to the US Geological Survey (USGS), the global nickel reserves in 2020 will be 94 million tons, unchanged year on year, with laterite nickel ore accounting for 60% and sulfide nickel ore accounting for 40%. Among them, Indonesia's nickel reserves remain unchanged at 21 million tons, which is still the country with the most abundant nickel resources, followed by Australia, Brazil, Russia, Singapore, Cuba, the Philippines and other countries. China is a nickel poor country with reserves of about 2.8 million tons, mainly concentrated in Jinchuan nickel mine, accounting for about 3% of the world.

Summary of the report:

Meet the bright era of nickel sulfate

The dual supply and demand matching of nickel is the core to understand the change of nickel industry. The supply and demand matching of "laterite nickel mine high nickel power battery" will open the bright era of nickel sulfate. In terms of dual supply, the supply of nickel sulphide ore decreased, while laterite nickel ore needed to be expanded; In terms of dual demand, the steady growth of stainless steel and the global trend of new energy vehicles with high nickel content will drive the accelerated growth of nickel sulfate demand; The traditional dual supply-demand matching of nickel can be divided into two paths, one is nickel sulfide electrolytic nickel stainless steel + battery, the other is nickel laterite stainless steel. We believe that the main contradiction of nickel industry in the long term in the future will focus on how to match the supply of laterite nickel ore with great resource potential with the increasing demand for nickel sulfate under the background of insufficient nickel sulfide ore resources. We expect that the supply and demand of nickel sulfate will continue to tighten from 2021 to 2025, and the gap may reach 65000 metal tons in 2025. The companies that can solve the above main contradictions and realize the supply and demand matching of "laterite nickel mine high nickel power battery" will get rich returns.

In the next five years, the CAGR growth rate of power lithium battery's demand for nickel sulfate will be as high as 40%. The demand for nickel in power lithium batteries is expected to be systematically higher than the growth rate of new energy vehicles. Firstly, the charged capacity of single vehicle will be increased, and secondly, the power batteries will be highly nickel. Our calculation shows that the CAGR growth rate of nickel sulfate demand in power battery field in the next five years will be as high as 40%. Although stainless steel is still the largest consumer of nickel, the power battery industry will have the largest growth rate of nickel demand in the future, and the proportion of battery demand is expected to increase from about 5% in 2019 to 17% in 2025.

Indonesia has become the main growth pole of nickel sulfate supply, and the barriers are gradually rising. Indonesia will be the main battlefield of nickel sulfate industry in the future. First, Indonesia is the largest nickel reserve and output in the world, and also the region with the largest new nickel supply capacity; Second, Indonesia has gradually improved its supporting infrastructure by banning mining twice; Third, it is close to China, the global lithium demand center; Fourthly, Indonesia's nickel market is still less monopolistic than that of the Philippines and sinca, so it has a good opportunity to intervene. There are three barriers in the layout of preparing nickel sulfate from laterite nickel ore in Indonesia, and the advanced entrants have the advantage. First, capital expenditure barriers. Indonesia's ban on raw ore export forces industrial capital to invest and set up factories locally, which will lengthen the capital expenditure cycle. The second is the barrier of mining right examination and approval. Due to the strong control of mineral resources by the Indonesian government, the barrier of latecomers is gradually raised. The third is technical barriers. Nickel project has huge investment and complex technology, which needs strong financial and technical support. By the end of 2020, there are 7 laterite nickel projects under construction or planned to be constructed in Indonesia for the demand of new energy vehicle industry, with a production capacity of 279000 tons. The planned production time is mainly concentrated in 2022-2023.

CO + Ni + cathode precursor (cathode) integration has a strong core competitiveness. Firstly, the high concentration of global cobalt and nickel resources determines that the resource availability itself is a barrier. Secondly, the capital and technical barriers of copper cobalt and nickel cobalt mines and smelting are high; Third, new energy vehicle manufacturers and battery manufacturers have high requirements for the stability, safety and consistency of battery material supply, which makes the upstream suppliers with high integration have strong bargaining power and customer stickiness. The upstream companies of cathode materials take the road of vertical integration. In essence, they integrate the middle and lower reaches with the monopoly power of resources, so as to reduce the cost, expand the scale, increase the market share and enhance the bargaining power after integration, and expand the monopoly power of resources to the monopoly power of cathode materials.

The global supply and demand of nickel sulfate and nickel is expected to be in shortage in 2021, and the gap will gradually expand in the next five years. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity are expected to usher in a major opportunity of revaluation. It is estimated that the global demand for nickel sulfate (physical quantity) will increase from 690000 tons to 2.84 million tons in 2020-2025, and the gap will gradually appear from 2021, with the gap of - 0.66, - 3.42, - 2.56, - 2.79, - 6.53 million tons respectively in 2021-2025; The global nickel supply and demand balance will be 176, - 9.10, - 12.15, - 14.55, - 16.12 million tons respectively from 2021 to 2025. The tightening of supply and demand will drive up the price of nickel sulfate, and then drive up the central system of nickel price. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity will usher in a major revaluation opportunity.

1. The dual supply and demand matching of nickel is the core to understand the change of nickel industry

1.1. Dual supply: the supply of nickel sulfide ore decreased, while laterite nickel ore continued to expand

The global nickel reserves are relatively concentrated. In recent years, the growth of global nickel reserves mainly comes from laterite nickel. According to the US Geological Survey (USGS), the global nickel reserves in 2020 will be 94 million tons, unchanged year on year, with laterite nickel ore accounting for 60% and sulfide nickel ore accounting for 40%. Among them, Indonesia's nickel reserves remain unchanged at 21 million tons, which is still the country with the most abundant nickel resources, followed by Australia, Brazil, Russia, Singapore, Cuba, the Philippines and other countries. China is a nickel poor country with reserves of about 2.8 million tons, mainly concentrated in Jinchuan nickel mine, accounting for about 3% of the world.

The tightening of supply and demand will drive up the price of nickel sulfate, and then drive up the central system of nickel price. The integration of cobalt nickel cathode materials and the target with nickel ore and smelting capacity will usher in a major revaluation opportunity.

Focus on Huayou cobalt industry, greenbeauty, shengtun mining, Luoyang molybdenum industry, etc.

5. Risk warning

1) The growth and high nickel trend of new energy vehicle power batteries are lower than expected;

2) The production schedule of Indonesia hpal project exceeded the expectation;

3) Nickel sulfide ore supply exceeded expectations.

鄂公网安备 42058302000221号

鄂公网安备 42058302000221号